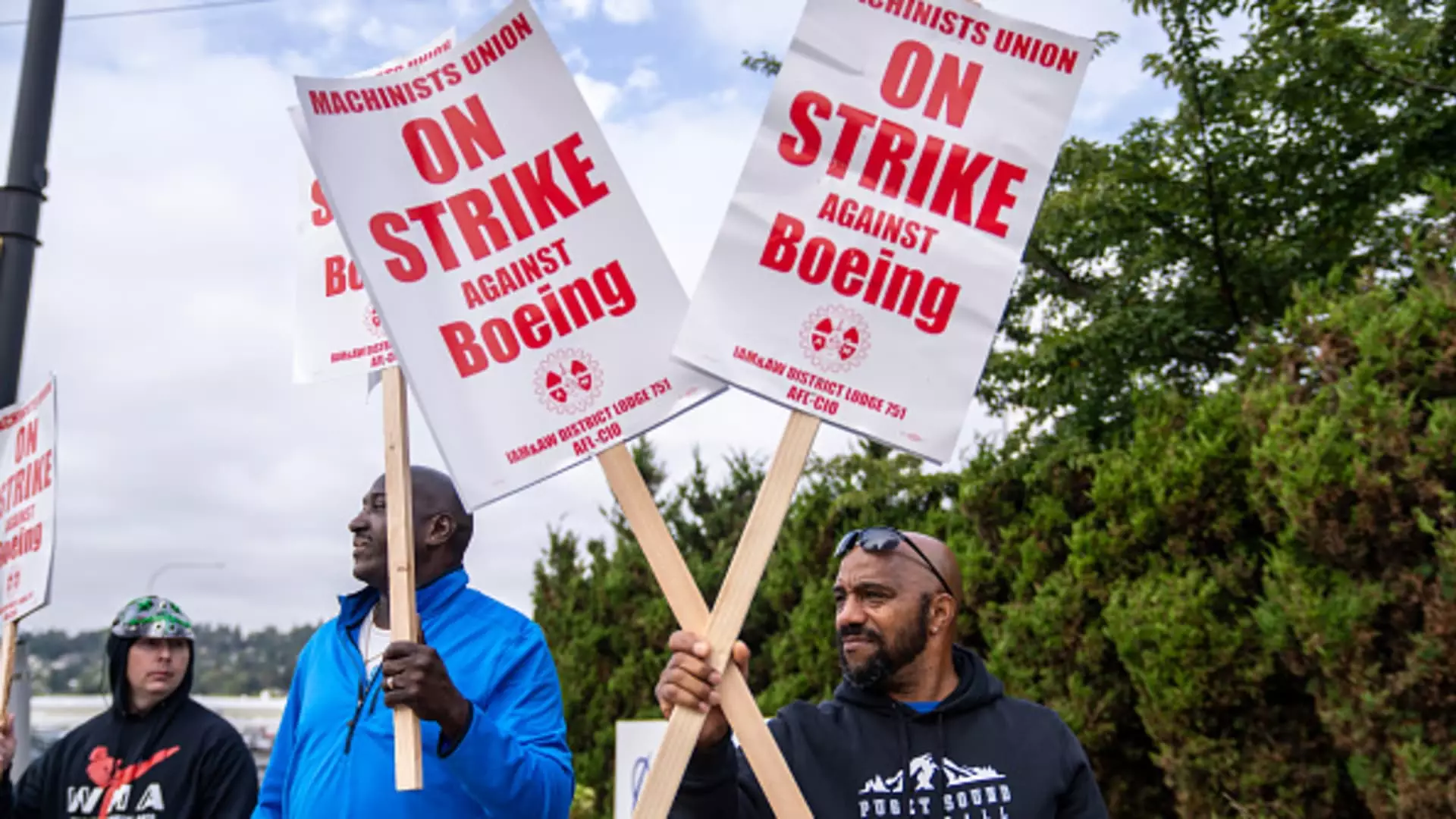

In recent weeks, Boeing has found itself embroiled in a labor strike that has significantly impacted its operations and financial outlook. Over 30,000 machinists represented by the International Association of Machinists and Aerospace Workers (IAM) have walked off the job due to dissatisfaction with a tentative contract agreement. This labor dispute has escalated pressure on CEO Kelly Ortberg, who was appointed amid a host of problems plaguing the aviation giant. The strike has not only fed into broader issues of labor unrest in industries around the country but has laid bare Boeing’s vulnerability amidst various operational crises.

Estimates from S&P Global Ratings suggest that the ongoing strike could cost Boeing over $1 billion each month, further complicating an already tumultuous year for the company. Earlier in the year, Boeing dealt with a near-catastrophic incident involving a 737 Max door plug, and the company continues to grapple with the aftermath of two tragic crashes that have diminished its reputation and earnings over the years. In light of these challenges, the decision to withdraw a previously improved contract offer has set the stage for protracted negotiations, as neither side appears willing to compromise.

Despite earlier optimism suggesting a smooth negotiation process, the failure to strike a deal has left Boeing in a bind, with production activities in key manufacturing hubs, particularly in the Seattle area, grinding to a halt. The ramifications of this production delay are severe, as it not only curtails cash flow but disrupts relationships with airline customers who eagerly await deliveries.

Union officials have indicated that the company’s efforts to negotiate may be falling short of worker expectations. Jon Holden, president of IAM District 751, has urged for renewed negotiations that prioritize the needs of the workforce, emphasizing that the resolution must arise organically from discussions rather than management threats. The withdrawal of health insurance for striking workers poses a serious dilemma for those whose paycheck has vanished due to the labor strike, amplifying the urgency for a resolution.

Nevertheless, not all hope is lost, as supplemental contract work opportunities have emerged in the Seattle area. This can potentially alleviate some financial strain for the striking workers, contrasting starkly with the more dire circumstances surrounding the previous strike in 2008. However, this fragile situation does little to resolve Boeing’s ongoing financial and operational issues.

The turmoil at Boeing prompted Ortberg to announce a global workforce reduction of approximately 10%. This announcement came alongside shocking preliminary financial reports indicating that the company faces deepening losses, with expectations of nearly $10 per share for the third quarter. This would mark a continuation of Boeing’s streak of losses, with no annual profits recorded since 2018. Such layoffs, while perhaps necessary for cost-cutting, raise concerns about the company’s ability to stabilize production lines, especially in relation to its flagship 737 Max.

Industry analysts are wary, suggesting that firing key personnel who could drive production efficiency is analogous to “burning down their own house.” The delicate balance of labor needs against financial viability can turn the course of recovery icy cold for the aerospace titan.

In the face of these formidable challenges, Ortberg has called for a reevaluation of Boeing’s business strategy that emphasizes core competencies over diversions that can dilute operational focus. The footprints of past decisions continue to haunt Boeing as it struggles to reinstate investor confidence. With stock prices crashing to lows last seen in 2008, the company risks being downgraded to junk status—a sobering prospect that reflects more profound systemic issues looming within its operational framework.

Bank of America analysts have posited that Boeing’s financial report likely signals an impending equity raise, potentially as high as $15 billion, to stabilize its financial footing. The wider implications of such instability extend even to Boeing’s supply chain, with manufacturers like Spirit AeroSystems facing uncertainty and potential job cuts.

Boeing finds itself at a critical junction. The convergence of labor strife and financial instability paints a grim picture but presents an opportunity for deep introspection and strategic realignment. Whether Boeing’s leadership can navigate this storm, emerge stronger, and lay the groundwork for long-term sustainability remains an open question.

Leave a Reply