The aviation industry is grappling with significant challenges as it struggles to emerge from the shadows of the pandemic. These challenges manifest as parts and labor shortages, delayed deliveries of new aircraft, and a host of maintenance difficulties that have led to an overflowing demand for aircraft engine repairs and overhauls. As travelers return to the skies in record numbers, airline executives confront a crisis that not only threatens operational efficiency but also impacts safety and customer satisfaction.

According to Alton Aviation Consultancy, the engine repair and overhaul sector has ballooned from a $31 billion market pre-pandemic to a staggering $58 billion in 2023. This expansion underscores the increasing reliance of airlines on engine maintenance services, particularly as many fleets consist of older aircraft requiring more frequent overhauls. Major players in the industry, such as GE Aerospace, Pratt & Whitney, and Rolls-Royce, are witnessing a fruitful surge due to this demand, positioning them for substantial profitability in the aftermath of the pandemic.

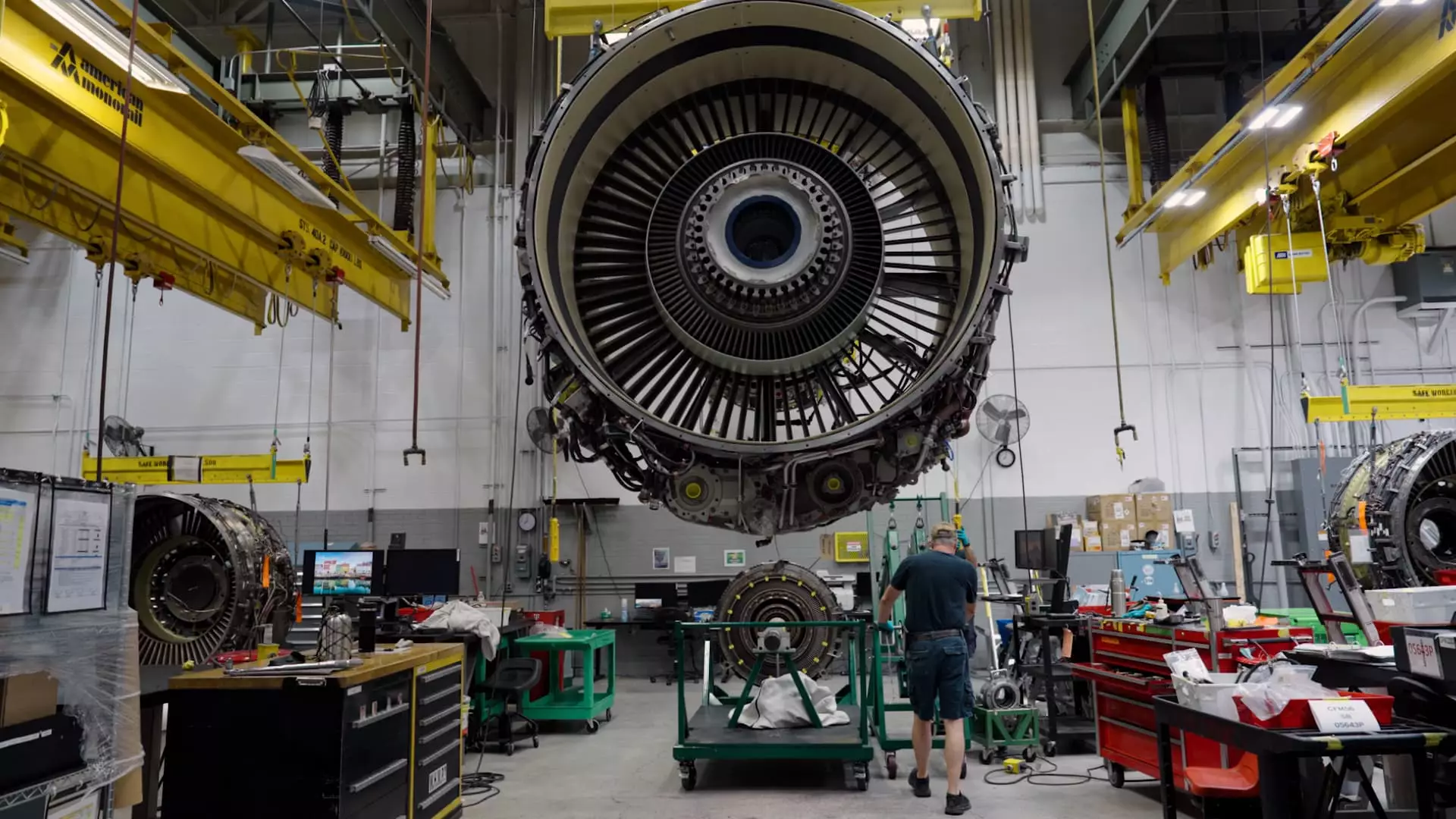

However, not all airlines are adopting a wait-and-see approach. American Airlines, for instance, has chosen to boost its internal capabilities by expanding its engine repair operations at its enormous maintenance facility in Tulsa, Oklahoma. The airline aims to ramp up its overhaul rate from five engines a month last year to over 16 by the end of this year. This strategic pivot serves not just to alleviate dependency on external suppliers but also to enhance the airline’s overall operational autonomy.

While airlines like American Airlines are attempting to take matters into their own hands, the industry is still contending with a significant bottleneck in engine repairs. The repercussions of the workforce reductions during the pandemic have become painfully clear. Skilled labor shortages plague engine shops, which are now inundated with requests to service engines that have gone far too long without necessary maintenance. Airlines that deferred service during the travel slump find themselves rushing to prepare aircraft for a traveling public eager to fly.

With new aircraft deliveries from industry giants Boeing and Airbus delayed, airlines are forced to hold onto older models longer than anticipated. The ripple effects of these delays compound the existing pressure on maintenance facilities, as older engines require overhauls approximately every 7,000 flights. A notable concern is the impact on routine maintenance schedules, which can lead to prolonged downtimes and costly delays in revenue generation.

The cost of engine overhauls can reach $5 million for narrow-body aircraft, with wide-body planes potentially accruing double costs. For many airlines, this represents a daunting financial burden, especially during a time when operational expenses are already soaring. Parts replacement, even for critical components like compressor blades, can elevate expenses even further, with costs for individual blades reaching $30,000.

However, the situation is compounded by delays stemming from ongoing issues with specific engine models, particularly Pratt & Whitney’s narrow-body engines. Delayed engine deliveries exacerbate the pressure on airlines, particularly low-cost carriers like JetBlue and Spirit Airlines, which have opted to defer incoming aircraft deliveries to preserve cash flow during a tumultuous period.

With demand for engines and parts soaring, the leasing market has seen significant changes. Rental rates for engines like the CFM56 have spiked dramatically, rising from $78,000 per month in 2017 to $96,000 today. This trend emphasizes the challenging landscape of engine supply, as carriers are now compelled to lease engines from firms that have been aggressively acquiring spare parts to meet heightened demand. Leasing firms, such as AerCap and Avolon, have seized the opportunity to bolster their portfolios, aiming to profit from the increasing pressure in the market.

Such dynamics illustrate the complex interplay between operational requirements and financial viability. Airlines like Delta Air Lines, which have taken on repair and overhaul work for other airlines, report full capacity in their engine shops, culminating in extended wait times for entities seeking maintenance services. As Delta CEO Ed Bastian notes, gaining access to repair facilities has become increasingly difficult for airlines scrambling to service their fleets.

The aviation industry is navigating through uncharted waters as it deals with the cumulative effects of a recent pandemic, labor market disturbances, and a critical need for engine repairs. While many airlines are adapting through increased in-house repair capabilities, the challenges are far from resolved. As the industry continues to push toward the recovery of pre-pandemic levels, significant adaptations will be necessary to ensure that airlines can meet the demands of modern air travel. The next few years will be pivotal as the industry seeks to overcome these hurdles and restore its operational effectiveness while maintaining a high standard of safety and customer satisfaction.

Leave a Reply