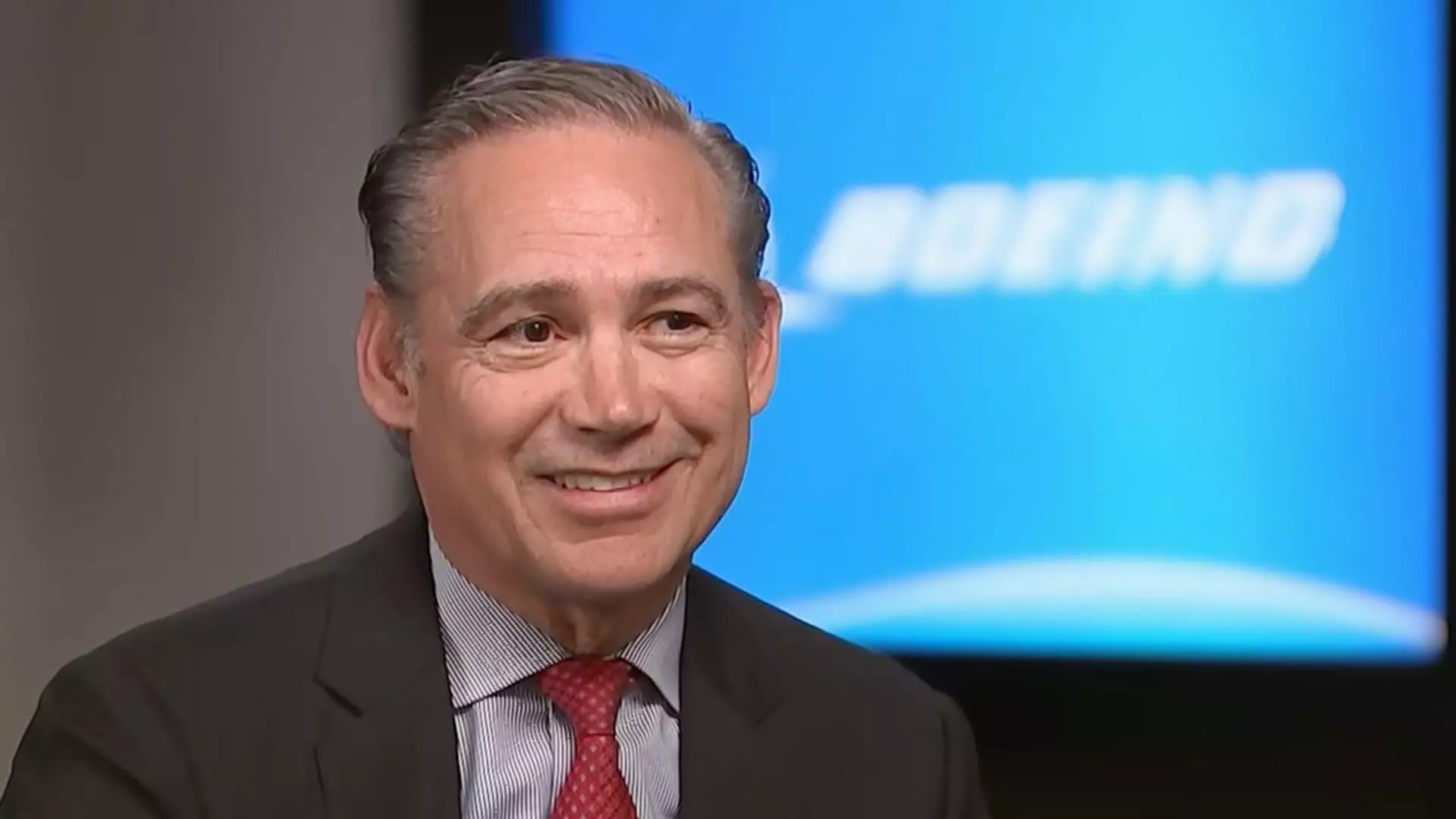

As Boeing navigates the turbulent waters of international trade tensions, particularly the significant friction between the United States and China, the aerospace giant finds itself reevaluating its delivery strategies. The recent cessation of aircraft deliveries to Chinese airlines is not just a symptom of a broader geopolitical rift, but also a pivotal moment that may define how Boeing adapts to evolving market demands. Boeing CEO Kelly Ortberg has indicated that the company is prepared to redirect aircraft initially designated for Chinese carriers to other markets, a decision reflecting both a proactive business strategy and an urgent response to economic pressures.

The Response to Tariffs and Market Demand

Ortberg’s remarks, detailing how some of the 737 Max planes meant for China have been returned to the U.S., underscore the factory-level implications of this trade war. The friction manifesting in a tariff-laden environment has created challenges not only for Boeing but also for the industry as a whole. The significant 145% tariff on Chinese goods highlights the extent to which political maneuvering can disrupt established business operations. Yet, in typical Boeing fashion, adaptability is key; the CEO’s assertion that there are “plenty of customers out there” for the Max aircraft indicates an optimistic outlook despite the current constraints.

This redirection strategy isn’t only about addressing immediate financial concerns but also about reinforcing Boeing’s market resilience. The company has gained insights from past struggles, particularly concerning the 737 Max itself, and appears determined to leverage these lessons in navigating the current economic landscape. The responsiveness shown by Boeing in taking quick action to find new customers illustrates a critical shift from a passive to an active business stance.

Recovering Financial Stability Amidst Uncertainty

From a financial perspective, Boeing’s recent performance shows that they are not merely reactive. The reported narrower-than-expected loss for the first quarter signifies an ability to manage cash flow effectively despite external challenges. The increase in aircraft deliveries suggests that Boeing is regaining some momentum, allowing them to sidestep what could have been a crippling downturn. By shifting focus from Chinese buyers to a broader base, they’re embracing a more diversified approach that may ultimately enhance financial stability.

Despite President Trump’s fluctuating rhetoric on tariffs and trade relations with China, which has ranged from punitive measures to a willingness to negotiate, Boeing’s strategic pivot is grounded in a necessity for survival in a changing market. Trump’s comments about reducing tariffs highlight a potential for negotiation, yet the uncertainty that hangs over the trade landscape makes Boeing’s decision to explore other markets both wise and timely.

Long-Term Implications for Global Trade Dynamics

Boeing’s current decisions extend beyond short-term financial survival; they signal a shift in how multinational corporations may engage with market uncertainties created by geopolitical decisions. The trade war with China serves as a stark reminder of how external factors can influence corporate strategies and the importance of agility in operations. As Boeing repositions itself, it might not just be the company that adapts, but an industry that must rethink how it approaches international markets.

The interplay of trade negotiations and corporate strategy will not only determine the fate of manufacturers like Boeing but may also shape the long-term landscape of global aviation and commerce. As such, this moment serves as a crucial touchpoint for understanding the broader implications of political and economic tensions on industry dynamics today.

Leave a Reply